- This event has passed.

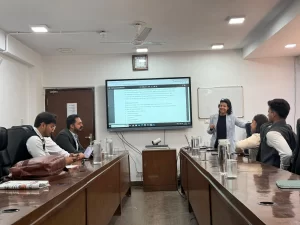

ACFE India Chapter Conducts Specialized Training for Indian Civil Accounts Service (ICAS) Officers

January 27 - January 31

The ACFE India Chapter recently conducted an intensive training session for officers of the Indian Civil Accounts Service (ICAS), who play a key role in managing and maintaining the financial accounts of the Government of India. These officers work in the accounting and financial management department of the Union Ministry of Finance, overseeing the financial integrity of government operations.

The training focused on equipping ICAS officers with advanced knowledge and practical skills in key areas such as:

- Fraud Prevention and Detection

- Diversion of Funds

- Financial Statement Frauds

- Anti-Money Laundering (AML)

A distinguished panel of experts conducted the training, sharing their vast expertise in financial fraud and risk management. The panel included:

CFE Sharad Saxena – A qualified Certified Fraud Examiner (CFE) and former diplomat who served at the High Commission of India, Fiji Islands, and the Embassy of India, Paramaribo, Suriname.

CA Siddharth Bansal – A Chartered Accountant with an all-India 35th rank, Siddharth is also certified in Project Management and holds a Diploma in Business Finance. He is a Registered Independent Director with the Indian Institute of Corporate Affairs.

CFE Gayatri Rattan – A leading Certified Fraud Examiner with experience in handling high-profile cases with CBI-EOW and SFIO. Gayatri specializes in Risk Advisory, Financial Forensics, Due Diligence, and White-Collar Crimes.

Training Highlights:

Fraud Detection and Prevention: Officers were trained on identifying signs of financial fraud, understanding common fraud schemes, and implementing safeguards to protect government accounts.

Internal Controls: The session emphasized the importance of strong internal controls to prevent errors and fraud, including how to design and implement systems that ensure transparency and accountability in financial transactions.

Anti-Money Laundering and Compliance: ICAS officers were introduced to the latest regulatory frameworks surrounding Anti-Money Laundering (AML) and financial compliance. This knowledge helps officers spot suspicious activities in government financial transactions and ensures they stay ahead of evolving financial crime risks.

This training session reflects ACFE India’s commitment to enhancing the skills of government officers, enabling them to foster a culture of transparency, efficiency, and accountability in the management of public funds.